The digital revolution has drastically changed the world around us. Whereas digitisation within many organisations used to be a multi-year plan, during the corona crisis it became clear that delaying is no longer an option. By now, almost all companies are engaged in large-scale transformation from analogue to digital data, process automation and cost savings.

The world of finance isn’t left behind in this regard either. Which FinTech technologies are transforming the credit management process? And what opportunities do they offer your organisation? Let’s look at a concrete application in which a number of such technologies come together: the data-driven credit management system, discuss how to set up such a system and finally, why amid all these new technologies, it is important not to lose sight of the human aspect either.

Content of this blog:

- Infographic: Changes in the finance world

- Digital transformations: the future of credit management

- Robotic Process Automation (RPA)

- Getting the ball rolling: Roadmap for data-driven credit management

Infographic: Changes in the finance world

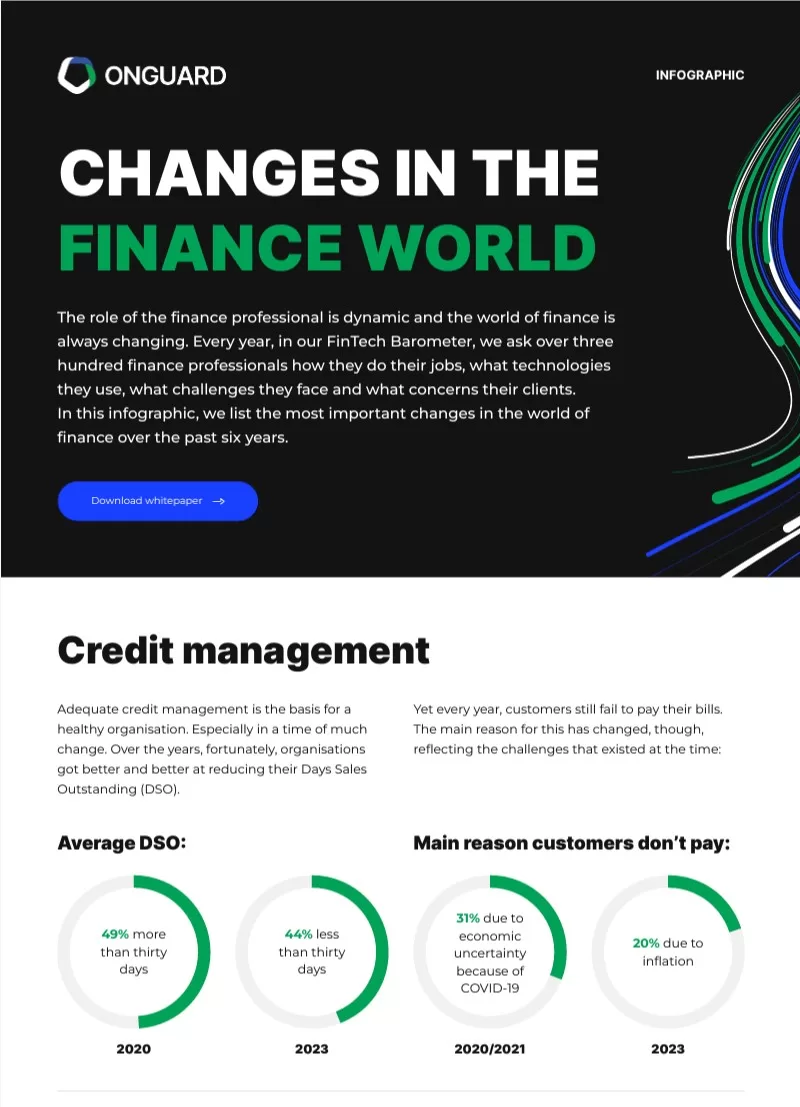

In addition to our comprehensive research involving over 300 finance professionals, we’ve meticulously compiled and condensed all the valuable data into our infographic: “Changes in the Finance World.” Delve into the ever-evolving landscape of finance, exploring shifts in credit management, payment methods, and the dynamic nature of late payments. Witness the culmination of our research, expertly presented in this infographic, offering you a clear path to financial excellence. Your journey begins here – open the infographic to uncover insights drawn from both technology and evolving human behavior in the finance world.

Digital transformations: the future of credit management

Big data & AI

Expectations of big data and artificial intelligence (also known as artificial intelligence or AI) have been high for years. Not surprisingly, as both lead to valuable insights into the credit management process. Suddenly, we are able not only to understand and analyse what happened in the past, but also to predict what will happen in the future. With that information, organisations can make forecasts, predict customer payment behaviour and deploy employees more efficiently. Moreover, AI is able to perform work processes independently and, combined with data, automate tasks.

Blockchain

A blockchain is an open and visible database in which transactions are made. The transaction must be approved by all computers in the network, making fraud almost impossible. This means that so-called trusted third parties such as governments, banks and notaries are no longer needed.

Blockchain technology offers numerous applications, especially within finance and logistics and in combination with the Internet of Things (IoT), in which everything is connected to the internet. For example, stocks in warehouses can be replenished, volume discounts calculated and invoices prepared.

If the blockchain states that a particular party has no financial space, the process automatically stops and a new order is not placed, all without third-party intervention. Thus, within the credit management process, blockchain can contribute to predictive actions.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is a valuable FinTech technology that can automate repetitive actions using simple “if-then” rules. RPA is often incorporated into technology even before it reaches the workplace of the finance professional. This application transforms the credit management process in such a natural way that finance professionals don’t even always realise it.

Intelligent Automation (IA)

Automation is a thing of the past. Since time immemorial, we have been trying to come up with clever tricks to minimise the number of actions we have to perform ourselves. But intelligent automation (IA) goes one step further.

With this technology, you tackle not only the relatively simple and routine processes, such as sending out invoices, but also those that until now seemed too complicated and unpredictable. Here, IA uses other technologies, such as AI or RPA. The software can independently assess situations and make predictions about, for example, customers’ payment behaviour. With that information, the finance department can tailor communications and actions to the expected situation. In this way, IA helps with faster processing and efficiency gains.

Web 3.0

Our current internet is focused on reading and writing, but Web 3.0 – the latest version of the internet – will be focused on reading, writing and owning. Where currently the power lies with large parties, like Google and Meta, the power will shift to individual users, like you and me. Everyone will soon be able to own an asset on the internet, adding value to your daily life. Not only as a consumer, but also as an entrepreneur.

Metaverse

The Metaverse is a virtual world, in which you have social interaction with other users represented by avatars. In the Metaverse, we don’t just look at other users, but are really part of their world. Making contact thus becomes so much easier than we are used to now.

The Metaverse also allows transactions to take place and digital currencies to be used. For example, children today are already familiar with buying skins; they no longer pay with fiat money, such as the US dollar or the euro, but with tokens. This opens up new opportunities for payments and investments in a virtual economy.

NFTs

Non-fungible tokens (NFTs) are unique, digital assets that can be traded on blockchain platforms, in exchange for, for example, digital art, real estate and other assets. Buying NFTs can give you access to a particular club or community and have the potential to transform the financial world.

Smart contracts

An NFT is a smart contract, but the reverse is not true. In a smart contract, you lay down certain agreements, to which you can add all kinds of conditions. You can automate outcomes and situations, for example as follows:

- If a wholesaler buys Z quantities of product Y and they pay within x days, the amount of the invoice amount should be A.

- If they don’t pay within the specified period, as defined under X, then the invoice amount changes to B.

Want to know more about the opportunities NFTs and smart contracts offer your business? Listen to our webinar on Spotify.

What opportunities do such FinTech technologies offer your business?

By harnessing the potential of the above technologies, you can increase flexibility and efficiency in your business. Use of smart software enables finance professionals to always have up-to-date data, interpret it and make new connections. As a result, important business information can be used strategically, for instance to optimise customer experience or deliver customised solutions.

In addition, software robots and artificial intelligence reduce errors and provide extra support. The software takes over repetitive actions, learns from them automatically and adds predictive value. Based on these insights, professionals can better anticipate customer needs, thus improving and personalising service. Moreover, you can use your employees’ talents for what they are really good at and take pleasure in, such as decision-making and customer contact.

Digitalisation in practice: free up time, money and attention

These new FinTech technologies have a lot to offer your company is clear by now, but how do you put such tools to practical use? One application in which some of these technologies come together nicely is in data-driven credit management software.

Such software makes it possible to bring together all relevant information about your customers, generate comprehensive customer profiles and segment within your customer base. This information reduces the risk of unpaid invoices and improves cash flow predictability.

Getting the ball rolling

Roadmap for data-driven credit management

Building a credit management system starts with collecting customer data. Think for instance about company size, sector, location, payment history and creditworthiness. For this, you can consult external and internal sources.

- Collect external data

You can collect external data from companies that provide financial information, such as Altares Dun & Bradstreet, Experian and Graydon. Their reports often contain customer ratings or scores based on financial analyses. Credit insurers also provide valuable information. They offer policies to organisations with cover for unpaid invoices. These insurers provide credit limits and additional information so that, as an organisation, you always know the maximum financial consequences if a customer, covered by this insurance, fails to pay. - Retrieve internal data

The next step is to retrieve internal information about your customers and their payment history. For this, you can dive into data from ERP, CRM and order management systems. These provide information on invoice details, contact details, sales opportunities and risks and cancelled orders, among other things. A complaint management system also provides insight into why some customers don’t pay invoices. For example, are any sent to the wrong address? - Segment customers

With the collected data at hand, you can then move on to customer specification and segmentation. This allows you to group customers with the same payment behaviour into the same segment, and then define a personalised strategy to, for instance, realise a quick payment. Identify which customers need more attention, and devote more effort and resources to them. Through such an improved customer experience, you can differentiate yourself from other providers and achieve better results for the entire customer portfolio, ultimately resulting in increased cash flow.

However, monitoring and manually tracking customer behaviour remains important; after all, such behaviour isn’t predictable and subject to change in all cases. For many organisations, this process is simply too labour-intensive and prone to errors. Fortunately, there are solutions available that can support your credit management process in this respect. Such systems monitor changes in behaviour within customer portfolios and then adjust strategies accordingly.

Successful digital transformation: find the right balance between people and data

Data-driven credit management thus makes dealing with debtors much easier. Yet technology can never completely take over this process. After all, human contact remains the key to a pleasant customer relationship – also with debtors. They are still customers that you, as a company, would like to see walk out the door with a smile.

After all, if the customer remains satisfied and loyal, they are more likely to come back to you in the future. And that matters, because retaining existing customers is as much as six times cheaper than acquiring new ones. Increasing customer satisfaction also has another positive impact on lowering DSO.

So finding the right balance between people and data is essential. By deploying FinTech technology in the right way, the finance professional gets the space to focus on customer contact: seeking connection, considering any personal circumstances and ultimately delivering customisation-with a successful customer relationship as a result.

Start optimising your credit management process and customer experience

At Onguard, together with our partner Alphacomm, we have developed various communication modules as part of our credit management solutions. This allows you to optimise your credit management process while offering personal customisation.

We designed the modules with the growing need for self-service in mind. Whether it is communication via a paper invoice with QR code, a text message with iDEAL payment link or, for example, a digital invoice: the customer decides how he or she wants to receive their invoice. You can also, for instance, send a personalised video or voice message, helping customers in arrears to understand exactly what they need to do.

And it works: over 90% of organisations using our communication modules experience higher customer satisfaction, according to Alphacomm. They report 25% of customers pay payment reminders faster and extra costs are avoided more often.

Curious? Find out more about how Onguard’s credit management solutions can help your organisation achieve higher customer satisfaction, faster payments and improved cash flow here.