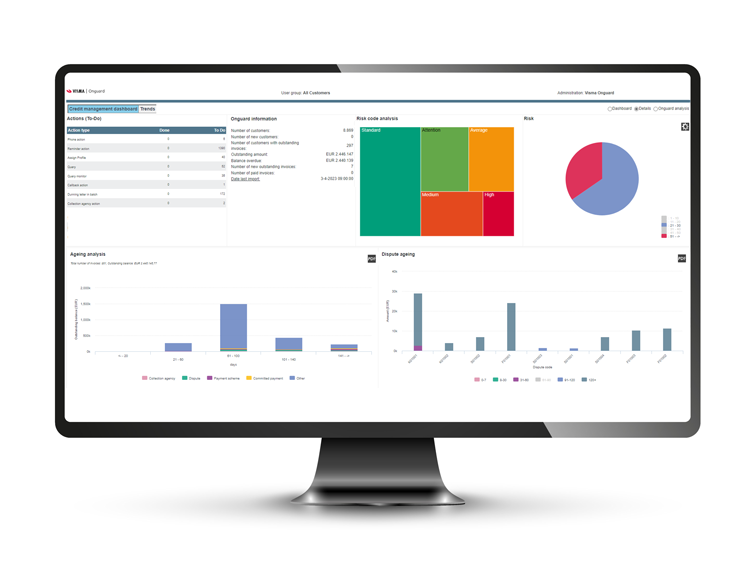

Credit management solutions

Automate and optimise your credit management process with CreditManager or CreditNext

Our credit management solutions automate repetitive tasks, segment customers and track outstanding invoices through automatic workflows. Free up time to focus on customers who require a more personal approach. Our complaints (dispute management) module supports you in correctly and promptly following up on disputes so that nothing gets in the way of a quick, full payment.

Get paid faster

with credit management software

Our credit management solutions, CreditManager and CreditNext, help you to lower your DSO. Getting paid faster is crucial for any business in order to improve cash flow and grow as a company. You have more bankroll to invest and can hire new employees quicker. It also means financial stability, giving you peace of mind. Bottom line, you want to get paid quicker. And you can - with credit management software.

Not sure which one is for you?

Let us help you choose

Two credit management solutions but which one is the best? There are some slight differences. Based on your needs we can advise which would be the best fit. Schedule a discovery call together with one of our colleagues and find out what your options are. We're here to help.

CreditManager

CreditNext

Contact us

Data provides insight

A good understanding of your customer base means you can take faster and more appropriate action with potential payment issues. With credit management software in place, customer history, data and associated risks help predict exactly which customers are likely to pay their invoices on time (and which aren't). Personalise your communication to each scenario and shield your organisation against possible risks.

Strengthen customer relationship

Gain full control over your debtor portfolio with automation and spend more time on the human aspect within your finance processes. Maintaining up-to-date customer data, means you choose the best approach every time. Personal communication tailored to your client's preferences means a better customer relationship and a positive impact on your DSO. A win-win situation.

Your choice is the same as theirs

Get the

conversation

started