Collection management with CaseControl

Collect unpaid invoices

Negate non-payment

with collection management

Need a more accelerated approach when it comes to non-payment? Transferring outstanding payments to a collection agency can get your outstanding invoices paid. But if the agency is also connected to our CaseControl solution, it's a win-win all around. Securely transfer overdue invoices to the collection agency and process debtor files with just the push of a button.

What can CaseControl

do for you?

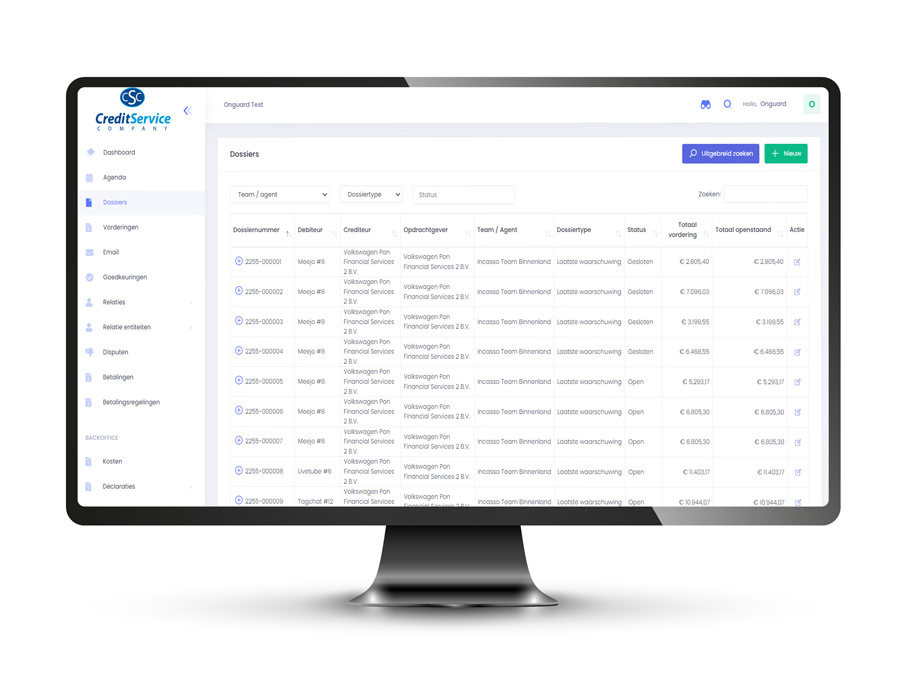

CaseControl is a highly scalable debt collect software solution, allowing you to easily and securely transfer overdue invoices to your collection agency. CaseControl manages amicable and legal workflows and actions, calculates fines and interest rates automatically and takes laws and regulations into account.

Gain control, with CaseControl.

Stay on point

Effortlessly check on unpaid invoices on a case-by-case basis with carefully constructed digital files.

Seamless integration

Easily hand over requests to your collection agency with the CreditManager API integration.

Efficient toolkit

All the tools you need to organise crucial work like creating files, invoice handling, reporting and more.

Join forces

We work with a best of breed partners

Team-up

A selection of our partners

Ready to talk

strategy?