CreditNext

For effective and efficient debtor management

Get paid

faster

CreditNext gives you all the tools you need for financial growth. We help you on a daily basis to lower the workload and provide you with clear insights.

Continue to evolve

With our hosted or on-premise solution

Industries, organisations and technological developments rapidly change the landscape in which we work. Your finance department and its credit management solution should not be left behind, as they are instrumental in ensuring the continuing growth of your organisation.

All advantages at a glance

Want to know more about CreditNext and how we can help you to reach your full (financial) potential?

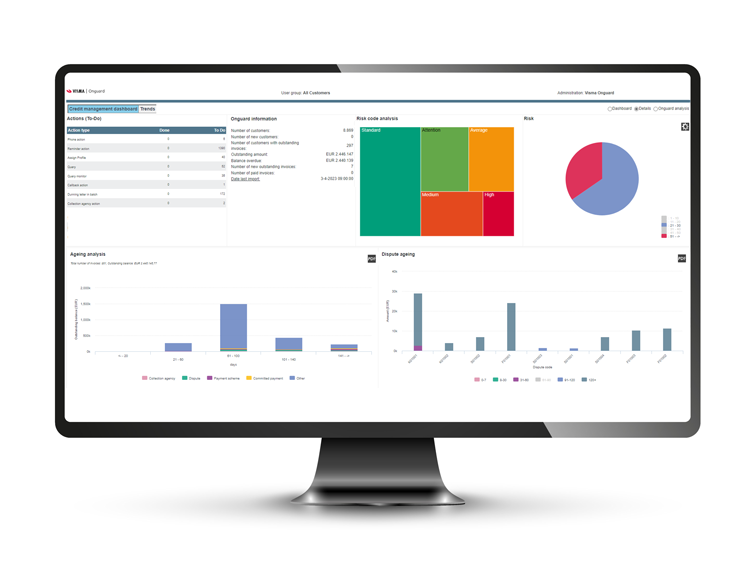

Innovative

We leverage the latest tools and techniques so our software serves you in the best way possible.

Scalable

Need to adapt or expand within your existing business environment or ERP in the future? No problem! CreditNext grows with your organisation and can accommodate an increased number of users.

Seamless

CreditNext has a complete integration of SMS and registered email channels. Easily communicate with your customers without having to switch between multiple platforms. Set up and automate workflows that work for you.

Ready to join these leading companies?

Meet other satisfied customers

Read how Onguard's CreditNext has helped other companies improving their credit management challenges.

Our customers

Join other leading companies

Get the

conversation

started