CreditManager

Get the most out of your debtor management

Get paid

faster

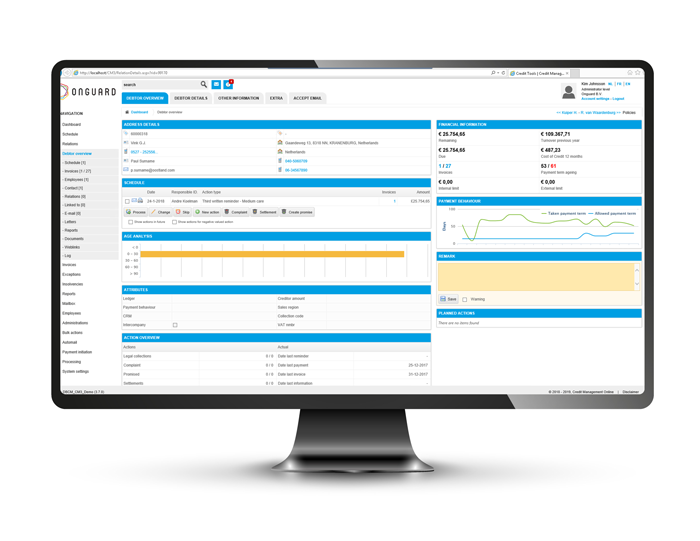

CreditManager is our cloud-based credit management solution that automates your processes. All the tools you need for an efficient and secure credit management strategy - in one solution.

Convinced yet?

Let us tell you more

We can go on forever about why CreditManager is the best there is. Don't just take our word for it, book a demo and see it for yourself, or download our factsheet below.

What can

CreditManager do for you?

Self-service with the Customer Portal

The Customer Portal allows your customers to view or download copies of their invoices, make online payments, register payment notices, raise disputes or ask questions. Convenient, insightful and time-saving not just for them but also for your own finance team.

Connect with Marketplace APIs

Sharpen your credit management process by integrating data exchange modules. Include current payment data and file information from the collection agency, or add risk information, e-invoicing or payment links. Credit management, exactly the way you want it.

Easy-to-use dashboard modules

Gain a (near) real-time overview of your daily to-dos, like processing received or outstanding payments, extending payment terms or dispute handling. The management and reporting modules give you full insight into KPIs, performance overviews and possible risks.

Our customers

Your choice is the same as theirs

Get the

conversation

started